- WHEN CREATING A BUDGET LOG FIXED EXPENSES HOW TO

- WHEN CREATING A BUDGET LOG FIXED EXPENSES SOFTWARE

- WHEN CREATING A BUDGET LOG FIXED EXPENSES DOWNLOAD

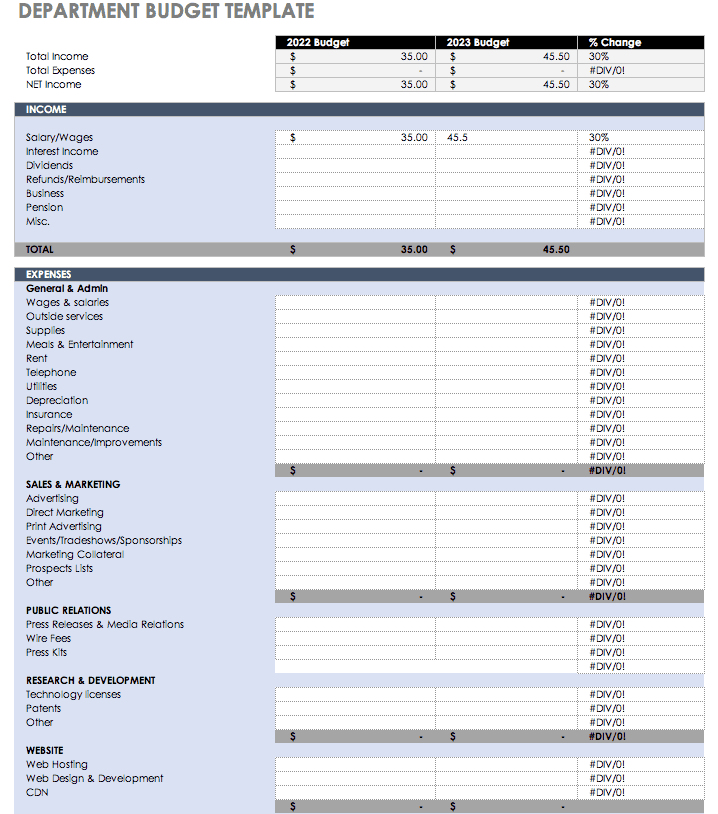

Even if you don’t have dedicated departments right now, this will make it much easier as you grow.įor instance, you should separate marketing software from accounting software rather than only grouping them as “software”. It’s important to categorize these expenses by department. We’ll dive into what those expenses are in the next section, but you probably have a good idea of what they include. Your startup’s budget should include all the necessary expenses to get your business off the ground and keep it operating month-to-month.

WHEN CREATING A BUDGET LOG FIXED EXPENSES HOW TO

Related: 5 Types of Budget Models (And How to Choose the Right One) What Should a Startup Budget Include? As you make adjustments and go through a few budgeting cycles, you’ll notice that your budget should start to become more accurate over time. You’re combining historical data and assumptions to predict how much money your startup will need to spend each month. One of the most important things to keep in mind is that budgets aren’t 100% accurate, and that’s ok.

On top of that, your budget should also include where the money will come from to continue to operate your startup.

WHEN CREATING A BUDGET LOG FIXED EXPENSES DOWNLOAD

Download our free startup budget templateĪ startup budget is an estimate of how much it’ll cost to start and run your business.Most importantly, it’ll help you be better prepared and organized so you don’t unexpectedly run out of money and become another statistic. Ensure you’ll be able to generate enough revenue to sustain your company.Forecast your budget for months in advance.Figure out what expenses to include in your startup’s budget (and how to categorize them).The most common reason why startups fail is that they run out of money.Ĭheck out our step-by-step guide on how to create and forecast your startup budget. It’s also not because they didn’t pick the right market or have enough passion for their product. It may help you stick to your plan if you remember the benefits of good money management: you could be debt-free - and with considerable savings - sooner than you think.It’s not because they had a bad idea. Sticking to your budget is often more difficult than creating a budget since it requires making lifestyle adjustments and having a certain degree of self-control.

Keep in mind that budgeting is only the first step. After that, track your variable expenditures and give them a certain percentage. Make sure you’re budgeting for the essentials first. The bottom line is to give all three categories a certain percentage and stick to it. Thus, you can start with this division, but you can change the percentage according to your circumstances if you need to save more money or have more needs. She says, “You can always change the percentages based on your lifestyle. 50% goes to necessities, 30% to wants and 20% to the savings category, also known as the 50/30/20 budgeting method. You should divide your expenses into three categories – needs, wants and savings. Know your financial habits and try to cut down on unnecessary costs.Ĭolleen McCreary, a financial advocate at Credit Karma, has the perfect tip for budgeting like a pro. Similarly, when you’re on a tight budget, you need to categorize things as “needs” and “wants.”ĭoes your room really need a fresh coat of paint, or are you just tempted to do it because you binged some room makeover video on YouTube the night before? To cut down on your variable expenses, you may have to make some lifestyle changes.įor example, if you’re currently eating out five times a month, you might want to reduce it to three times to lower your variable costs. Try saving money on your groceries since they form the most significant part of your variable expenses. However, once you create a clear line between what is essential and what isn’t, budgeting will be easier for you.įor instance, some supermarket purchases you pick up on your grocery runs are considered “a waste” by experts. Since variable expenses keep changing, you might find it hard to manage them. Here are some examples of variable expenses: For example, if you have a medical emergency, you have no choice but to head to the hospital and pay your medical bills. However, not all variable expenses are in your control. For instance, if you’re buying clothes, you can choose to go to a thrift shop rather than a designer boutique. Another thing to note about variable expenses is that you often have a high degree of control over them.

0 kommentar(er)

0 kommentar(er)